BRICS+: One Year Later

Email: decodingpolitics@protonmail.com

Substack: decodingpolitics.substack.com

Twitter: twitter.com/DecodingPoliti2

*Not financial advice, merely pointing out political and macro trends*

With all the news focused on various domestic political issues (govt shutdown, AI, Epstein etc), we decided to revisit the global picture.

A year ago we introduced you to the BRICS+ coalition and its members and institutions. We went through what this coalition wants. We went through the major hot spots. And the likely outcome. We keep the post pinned because it’s essentially our world view of how things will play out in the next decade or so.

Continue to stay focused on gold and other metals, be careful with Chinese tech, and continue to be bullish on Latin America and the neutral countries (UAE, Qatar, Saudi, Malaysia to name a few.

World War 3

It should be obvious now that WW3 is in progress and has been for a while. It looks different from WW1 and WW2 and is playing out more like past combined military/economic conflicts- say the Opium Wars.

Russia is leading the conflict on the battlefield with heavy Chinese support. China is leading the economic war, going toe to toe with America, and winning. Iran is the junior partner doing its best to humiliate the West’s junior partner. At this point the West is also losing the global public opinion badly by supporting Israel and seemingly arbitrarily provoking China and other nations.

Ukraine Theater

Russia continues to push NATO out of its backyard and escalate the conflict. We thought there was a small chance Trump had a card up his sleeve to force a deal. That was not the case.The Zelensky grift goes on in this unwinnable war.

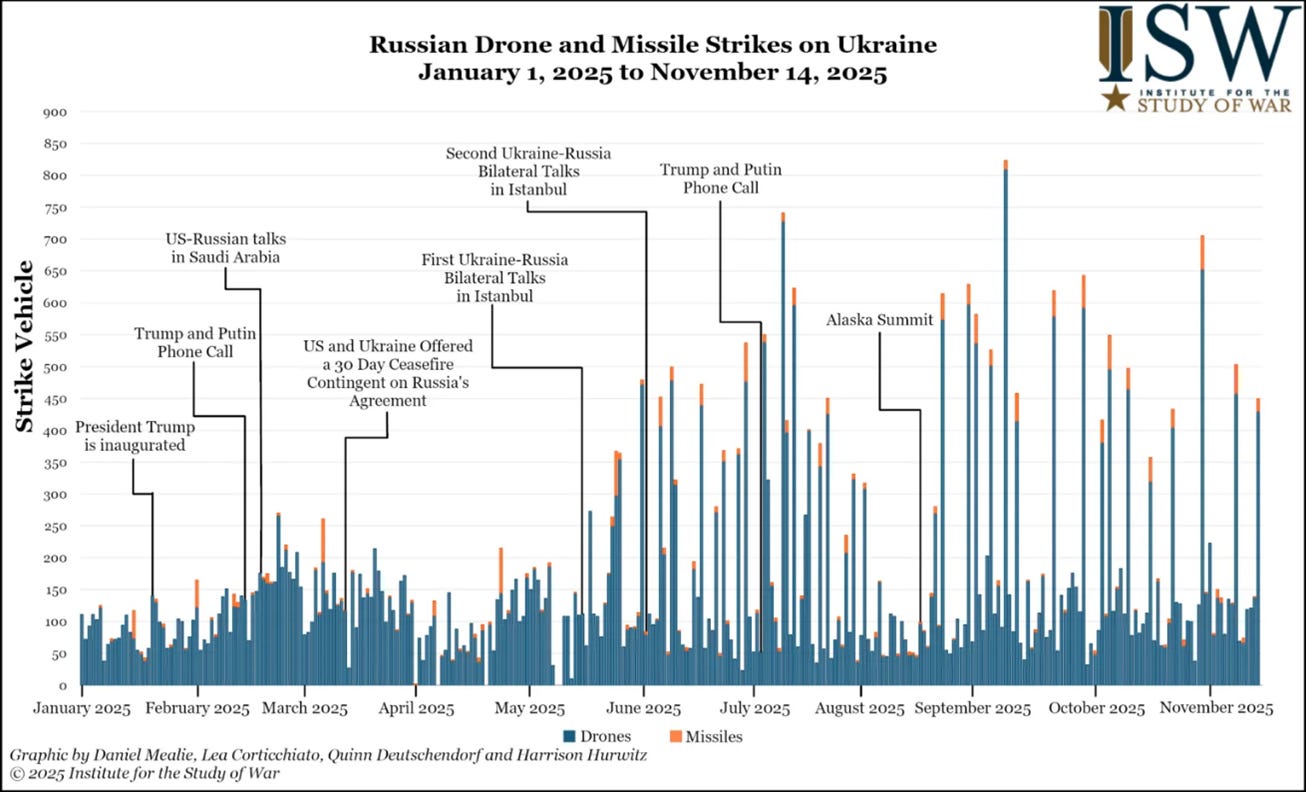

Trump’s failure to secure a deal meant he was outplayed by Putin. Trump’s deal to control Ukraine’s resources looks nice on paper but will be unenforceable in reality. Russia is using more Chinese drone targets and now trying to take out the civilian infrastructure of Ukraine.

The Middle East

Iran’s indirect regional war with Israel turned into a direct hot war for two weeks. But conflict burned on for over two years in Gaza. It’s paused now. Gaza is wrecked and Israel’s reputation has a black eye globally. But the myth of the IDF, the Iron Dome, the Mossad, are all smashed now. Israel’s next conflict will much tougher. We think Trump successfully sorted out a calming of the two sides but as along as there are two regional adversaries it will keep going, Also with the US so committed to stopping Russia and China it had to wind down what it thought would be a third theater and potential point of escalation.

NATO did get a victory with regime change in Syria. Forcing out Iran’s partner and putting in a guy who is obviously a CIA asset [he was almost immediately invited to the White House and was on 60 Minutes!] benefits its position in the region. The Gulf nations are moving in for deals, such as getting to operate Syria’s ports and develop energy. It allowed Israel to gain territory and gave it one less place to worry about. But it’s a sideshow. As the forces were mainly Turkish or Turkic, it strengthened Erdogan’s hand in playing the BRICS and NATO against each other, a game he long ago mastered.

The Americas

While China takes over the Global South, the US is consolidating its control in the Americas, a move that been in progress since the Ukraine War. This locks down resources for American business and is meant to scare away Russia or China. But it also means that America’s global footprint will soon have to keep shrinking elsewhere- Asia, and the Middle East now, a process going for the last 15 years. Eventually it will have to shrink in Europe too.

First, America is bossing around Mexico again after leaving AMLO alone. It needs to work on issues like cartels and migration. And it needs to let Mexico know the limits of Chinese economic investment it will allow. Mexico also has energy assets but an incompetent state run company, so we imagine that the Super Majors from the USA will put a little pressure here.

Argentina got a big bailout and an all in for Milei. It’s not because he Trump and Bessent are buddies. It’s because they can’t let the second best shale in the world field fall away. Having China or someone else get control of it be able to drive super cheap data centers would be a huge loss for the US strategically. And it has a brand new naval base it doesn’t want to have to turn into Guantanamo 2 or lose.

Now Venezuela is coming into view. There was an attempt at regime change under Trump’s first term. Then there was diplomacy with the Biden regime which got American energy companies back and operating there. Now the US is squeezing the regime hard and their drug operations. The US did this somewhat successfully in Colombia and Panama before. And they showed up with a big naval fleet and threatening to invade. They won’t invade, no one wants that. But they will keep using the military to squeeze out a diplomatically acceptable deal.

Russia, China, many international gangs and terrorist groups have set up shop in Venezuela. Of course the US would want these all gone over a designated period.

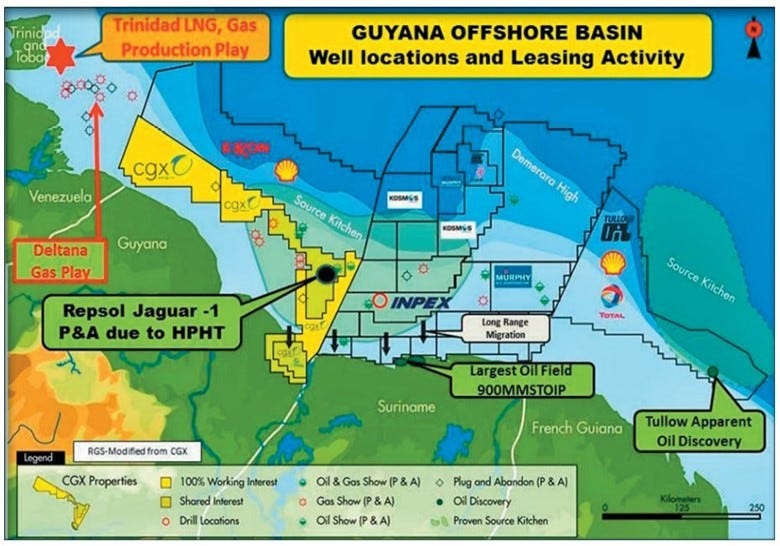

Finally, the US needs those energy assets of Venezuela, the largest in the world. The country has huge potential in oil and gas. No one has yet explored its deep offshore fields that nearby Guyana and Suriname are producing from.

Doomberg’s substack is very good on these topics and we appreciate some of the points he made. https://substack.com/@doomberg

The remaining question is will anything similar happen in Cuba? China has been cozying up economically to Cuba over the past ten years. Cuba and nine other nations joined the Belt and Road Initiative. Similar to other places, it’s rumored the Chinese have set up an extensive spying operation. Cuba signed a Russian military cooperation agreement. It is also home to our important Guantanamo Bay base.

But the country is poor, and has no energy. It has no military threat once it’s surrounded by US allies. It has only 11m citizens and that’s declining. We think that in the end it won’t be worth the US’s time unless there is a significant change in domestic Cuban politics.

Economic War With China

Undoubtedly speeding up US urgency on all fronts is the ongoing economic war. China and the US continue to escalate on tons of issues. China and the US are in an economic war, on every front: tariffs, AI, rare earth minerals, energy etc. The shooting will start directly in a few years, but it’s hard to predict timing and locations. China learns US weaknesses and builds up its military in the mean time.

The headlines everyone saw:

- The Netherlands nationalizes Chinese semiconductor company. China suspends shipments to it

- New limits on chip sales

- Nvidia’s CEO says China is just nanoseconds behind in AI

- The US and China fight over rare earth minerals and the US caves

- The US government is scrambling to lock down supplies globally but nearly all the supply chain is China controlled

- China continues to print $90bn per month trade surpluses despite this year’s threats of tariffs

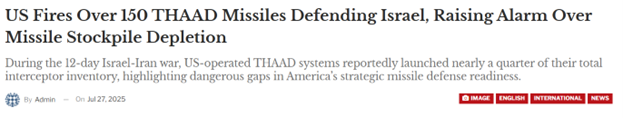

Just like Japan and the US continued to escalate economically for years before Pearl Harbor, we see the same path. China is patiently waiting. It can work with Russia and Iran continue to turn the screws on the US. It can continue to build its navy, drone, and missile capacity where it has vastly better technology. The US can barely produce new missiles and most of its stock went to Ukraine and the Middle East.

When the shooting starts it will shock the world. US military commanders have been warning about China’s already formidable and rapidly advancing technology for years. China’s industrial power and control of key inputs like rare earth minerals will mean it can far outproduce the US. And US military weakness and corruption except in special operations is obvious to everyone- Iraq, Afghanistan, Ukraine, the Red Sea. When it has to fight Russia and China it will rapidly have to throw in the towel.

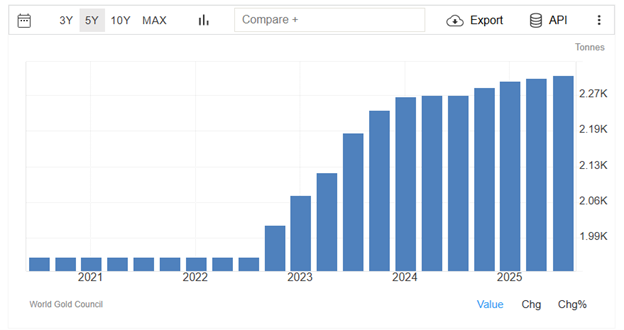

Gold

As we wrote in our pieces on gold, the BRICS+ no longer trust the US dollar standard. They have been saying their assets confiscated by Western governments and now are looking for a neutral asset. That explains gold’s 50% rally and the continued rise in China’s reserves. We don’t think this trend stops.