October 2025 Monthly, Part 2

Argentina’s Midterm Election, The End of Maduro in Venezuela, There’s (Still) No Oil!

Email: decodingpolitics@protonmail.com

Substack: decodingpolitics.substack.com

Twitter: twitter.com/DecodingPoliti2

*Not financial advice, merely pointing out political and macro trends*

A quiet couple of weeks for the global markets. Stocks have traded well, gold has cooled off, and bonds have been a mixed bag. No major news stories have dominated.

We decided to look at three isolated events this time, keeping you ahead of the curve on three major themes of ours. Two you have heard about before: Milei is For Real, and There’s No Oil. We will update you and show why we think we are at important positive turning points in both. Milei’s victory tonight will lead to a large rally tomorrow and this week.

We are adding a new discussion point which will very likely become a theme over coming years as it becomes investable: Venezuela after Maduro. The Trump administration’s negotiations and military pressure look like they will finally get the country to pull the plug on his disastrous regime and re-open for business. It will turn into a party for foreigners over the next 15-20 years. Start learning now.

In a couple weeks, we will be back to the Fed, US fiscal policy, the UK and other fun more mainstream topics.

1. Argentina’s Midterm Election Results

2. Venezuela- Maduro On the Way Out

3. Oil – Update, No Inventory, Record Shorts

1) Argentina’s Midterm Results

This substack has followed Milei and Argentina closely for years now. We had previously written about today (October 26th) ‘s pivotal midterm elections in Argentina. With half of the Congress and a third of the Senate up, this would be a crucial test for his government. Success in this election means more reform and momentum for Milei. A poor result would mean his agenda remaining stuck in Congress the next two years, and likely a prelude to a 2027 electoral defeat.

We came in far more positive than the market on this. On September 25th, as Bessent announced a backstop for the country we recommended going long Argentine assets into this election and outlined the many reasons why. We may sometimes take a while to get to the point, but, we hope that our message in that post was abundantly clear and you took advantage:

“This is the highest conviction call and best risk reward we have seen since starting this substack.”

As of this evening, what do results look like? Turnout came in lower than expected, just over 67%.

But all in all, the results are very good for the Milei government. His party triumphed by 9% over the Kirchnerist wing, far ahead of expectations

This will undoubtedly catalyze a big rally this week. The peso is already rising by 7% in the overnight crypto market. ADRs should be up 12-20% tomorrow.

Milei’s improbable run continues. We can expect now six more years of economic reform and a virtuous economic cycle.

Viva La Libertad Carajo!

2) Venezuela- Maduro On The Way Out

After being off everyone’s radar for years, Venezuela has returned there in the past few weeks. President Trump has led a big push against Maduro diplomatically and in terms of anti-drug operations.

Venezuela’s Downfall

Let’s rewind and give a brief history of Venezuela’s descent over the past 30 years. Once a prosperous and stable country, Venezuela ran into some problems in the 1980s and 1990s oil bust. In 1998, former paratrooper Hugo Chavez was elected president on a socialist platform campaigning against corruption and incompetence. He won again in 2000. The US was none too happy and launched a coup attempt in 2002. That did not succeed, and Chavez dug in. Oil workers began to strike against Chavez and majors began to withdraw.

Hugo Chavez

The oil boom of 2003-8 brought a reprieve for Chavez and he was able to ride it to a new term in 2006. Over this decade (2000-2010) Chavez bulldozed the private sector and political opposition in every way possible. He stole elections. He buddied up to drug traffickers, Castro’s repressive regime in Cuba, as well as China, Russia, and Middle Eastern terrorist groups like Hizballah.

Economically, Chavez nationalized nearly everything he could. Grocery stores, telecoms, energy assets, you name it, all got put under government control. Chavez’s cronies ran these companies with little regard for outcomes and much regard for lining their pockets. The country’s services completely broke down under this period and hit a brick wall of shortages and hyperinflation.

Chavez remained president until his death in 2013. The office was turned over to Nicolas Maduro, who remains the president. The former bus driver and union organizer has not had the benefit of an oil boom and the country has become a disaster. The US attempted a coup again in Trump’s first term and is now negotiating an exit for Maduro (more on that in a bit).

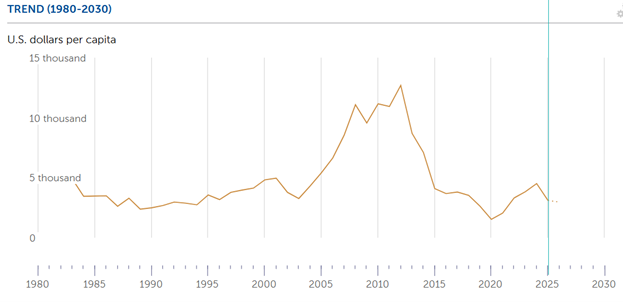

Venezuela GDP per capita is now hovering around $3,000 per capita. This is lower than the 1980’s. This chart is NOT adjusted for inflation in dollars- if the US has experienced a cost of living crisis in the past few years, imagine how much worse it is in Venezuela!

Source: IMF, https://www.imf.org/external/datamapper/NGDPDPC@WEO/VEN

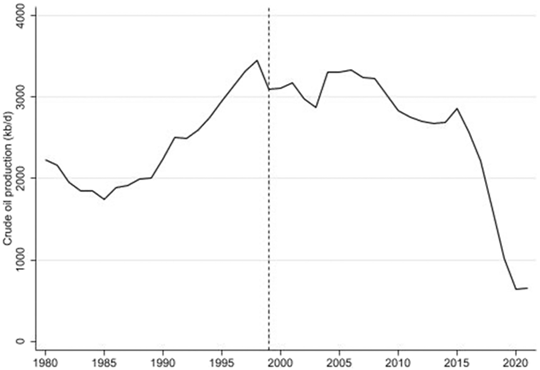

The country’s principal source of revenue and exports, oil production, collapsed under the Chavez/Maduro reign of incompetence. At the beginning of the Chavismo era it averaged over 3m barrels per day. It fell to almost a tenth of that recently.

Source: Science Direct

It has gradually recovered to back over 1m barrels per day recently, but the damage has been done.

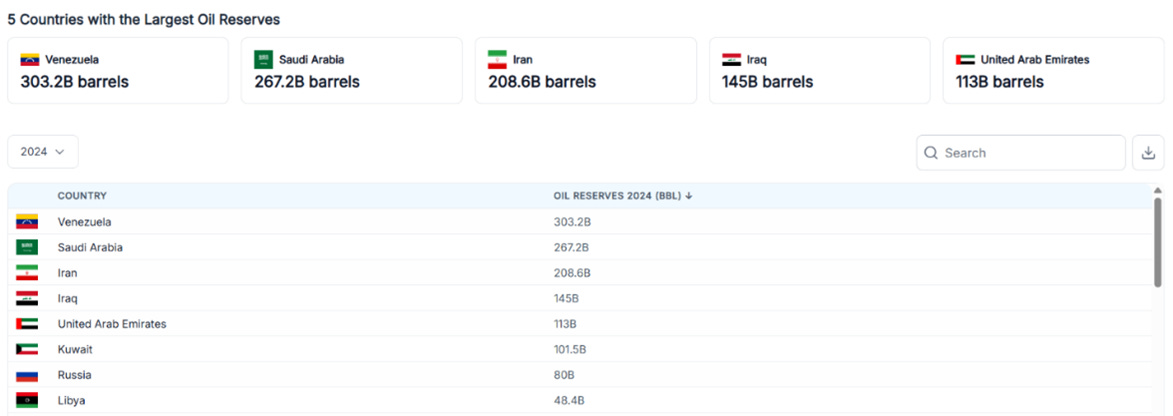

Making this statistic even crazier is the fact that Venezuela has the largest conventional oil reserves of any country in the world! It has 300bn barrels of proven reserves, more than Iraq, Iran, Saudi Arabia or Russia. It has seven times the reserves of the USA.

With no dollars coming in from oil and rampant government spending, Venezuela entered hyper-inflation. Ten years ago, inflation was ‘only’ in the 90-100% range. By 2019, it had reached a mind-boggling 340,000%. Now it’s comfortably contained in the 200% range. Savings in the country have been wiped out. The country has defaulted on external debt and remains shut out of international markets.

Perhaps the cruelest irony of this whole story is the story of Chavez and Maduro’s inner circle. Investigations have revealed hundreds of billions of dollars siphoned from state and state oil coffers over the past twenty five years. The man of the people and socialist hero allowed a clique to get absurdly rich committing fraud. The richest Venezuelan is now….Chavez’s daughter, worth over $4bn. She of course now lives outside Venezuela, in Madrid.

This publication nearly always does not pick sides or criticize political leaders/movements. We instead just try to predict what will happen next and how to prepare financially. But we cannot help but be appalled at leaders who ruthlessly enriched themselves and their associates while plunging a country into misery.

Venezuela Since the Collapse

Venezuela defaulted on its debt in late 2017. Then came 2019’s hyperinflation. The US imposed several rounds of sanctions in 2017 ,2018 and 2019 on Venezuelan individuals, companies and on trading the sovereign debt. Those have remained up until now. Several million people have left the country of formerly 30m and fanned across North and South America.

The country went to a partial dollarization in 2019 out of necessity. They have gone back and forth at the margin but acknowledge that a full bolivarization would cause the economy to halt. But a full dollarization is impractical given the sanctions regime.

Venezuela has also survived by cozying up to Russia and China. Both maintain oil operations in the country and military assets. The government has also let organized crime groups and terrorists rule with impunity. Foreign groups like Colombian drug traffickers and Hizballah control whole provinces of the country. Local grown gangs like Tren de Aragua have a huge presence in Venezuela and now the USA.

The Maduro government agreed to free some prisoners in exchange for a sanctions rollback under Biden. But free elections were not held and that agreement fizzled out. In an attempt to get things moving again, President Trump and his Secretary of State, Marco Rubio, have begun a new round of negotiations to force change in Venezuela.

Trump Administration Actions

Trump returned to power in January 2025. Since then he has made a full court press to clean up Venezuela. Negotiations were started and reached a fast pace over the summer. By September a deal had been worked out.

The deal involved lifting sanctions in exchange for US access to markets. But apparently Rubio rejected the deal in the end over a political sticking point. It would have seen Maduro transition out gradually and give power to his current VP to serve out his turn. New elections would be held in three years. The US by contrast wants Maduro immediately gone and fresh elections as soon as possible. It views Madruo as an illegitimate President who won through fake elections.

October 15, 2025

Over the past few weeks, the US has ramped up the pressure. They moved several destroyers and an aircraft carrier into the Carribean theater. They have done a number of strikes against ‘drug boats’ headed to the USA. There is now talk of open CIA operations in the country. Is Trump trying a coup?

We think this is just the final push in negotiations. Trump wants Maduro gone. Maduro has little personal support and only remains in power due to the support of the generals and gangsters around him. If Trump can hurt their revenue and build up enough pressure, they would probably consent to having their President leave now. Threatening land strikes means no one is safe now- a few bombs dropped on generals’ compounds will surely get them to the table ASAP.

The Outlook

Venezuela is going to be brought back in from the cold soon. The Trump administration has already gotten 90% of what it wants and will keep up military pressure to get the full 100%.

Trump ran on no new wars. A blatant coup or decapitation strike in Venezuela would not go down well with anyone in the US or the international community. But squeezing the government hard enough to get them to accept his terms would. We would imagine that this is all wrapped up by year end.

The first benefit is, similar to the US’s moves with Argentina, it takes a key Russia/Chinese ally off the map and flips it back to US control. That would basically leave Cuba as the only holdout in the Americas. And it would greatly reduce the ability of drug gangs and foreign terrorist groups to operate unmonitored.

Ending a repressive, autocratic and socialist regime would be a major win for American soft power. It could also help to unwind the humanitarian crisis that has put pressure on two dozen American countries over the past decade.

But most importantly, it would open vast new oil resources and deals to American companies that have been shut out for two decades. Venezuela has been an autarky since the shale boom in the US. The combination of an open-for-business country and US majors’ expertise would create a bonanza in the country unseen in decades. Major US companies, especially tech and financial companies, would have a market largely untapped by foreign competition. Venezuela tourism, long in the doldrums, would take off again. The country shares the same Caribbean beaches as neighboring Cartagena, Curacao, Aruba, and Trinidad. It has the world’s highest waterfall and part of the Amazon basin. It should become a tourist destination in time.

We expect the architecture of a deal to emerge in the next three months. Maduro gone, a transition government and a timeline to new elections. After that, we would start to see the economically relevant stuff: debt restructuring, debt for asset swaps, ending sanctions and foreign investment rolling in. That will take three to five years to really implement and so will be seen after Trump’s second term. The resumption of production will not hit oil markets for several years. Venezuelan debt now being sanctioned, only foreigners holding assets outside a US bank can play this. But the opportunities over the next two decades will be so big that it is worth starting to follow the story now.

3) There’s (Still) No Oil And Now Record Shorts

One theme we have kept in the themes list for the past three years is that there’s no oil! Inventories are low globally, and big new production is scarce. Existing fields are not replacing themselves and seem to keep underperforming targets. While oil has been a range for several years, we think a move to a new much higher range is coming.

Despite that fundamental story being intact, oil has remained range bound. The oil price had a big run up in late 2021/2022 on Russia Ukraine war fears, and has spent the past three years taking out that premium:

December 2025 West Texas crude price

It’s essentially hovered around $60-70 for the past three years. Oil stocks, represented by the ETF (XLE) have fared better. They are only about 10% below their 2022 and 2024 highs. A sustained re-rating in oil would probably see these stocks move much, much higher. A break over that 100ish level, technically speaking, would set up this ETF for a run to 200.

But we think that a move to a higher range is coming in 2026 and 2027. The EIA is forecasting a major glut in supply for this year and next year. We would like to note that despite two major producers raising production (US and OPEC+) this year, oil prices have recently traded higher not lower on the news. This would imply that the worst is in the price and expectations are too cautious in the marketplace. This headline this week from oilprice.com nicely shows the dynamic:

What fundamental catalyst could reshape the oil market to rerate higher? Let’s go through three or four.

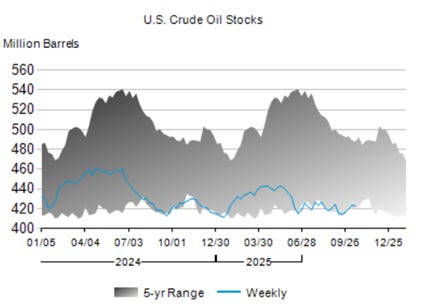

First, let’s take the US inventories position, which is approaching critically low levels. Crude oil stocks are at the lows of the past five year range:

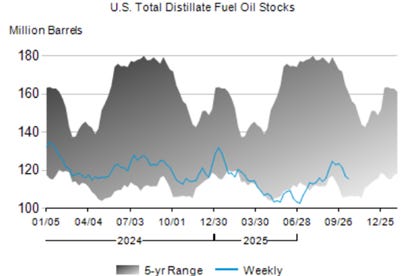

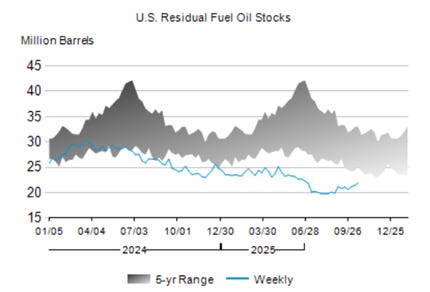

Same with fuel oil and with residual fuel oil:

Gasoline stocks are slightly better:

Even a move back to ‘normal’ ranges would imply a large inventory demand in oil in the US.

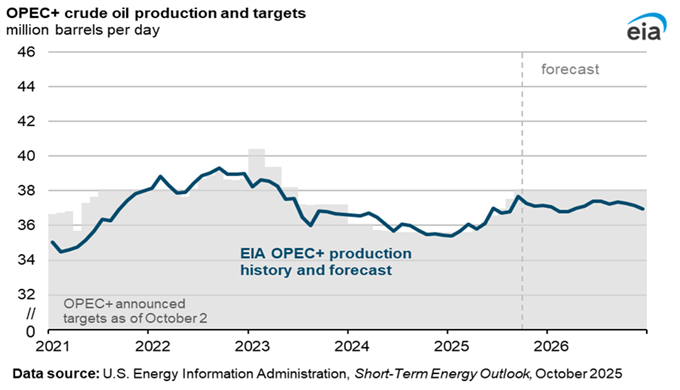

Secondly is the expectation that production from two major sources will stop growing in 2026. After hiking almost 2m barrels per day in 2025, OPEC+ is expecting to stop raising production for next year:

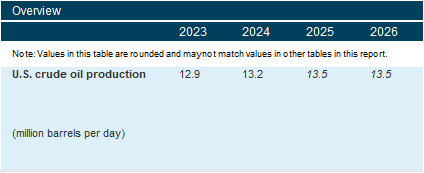

Similarly, for US production, the EIA is seeing flat production after growing several hundred thousand barrels per day in the past three years:

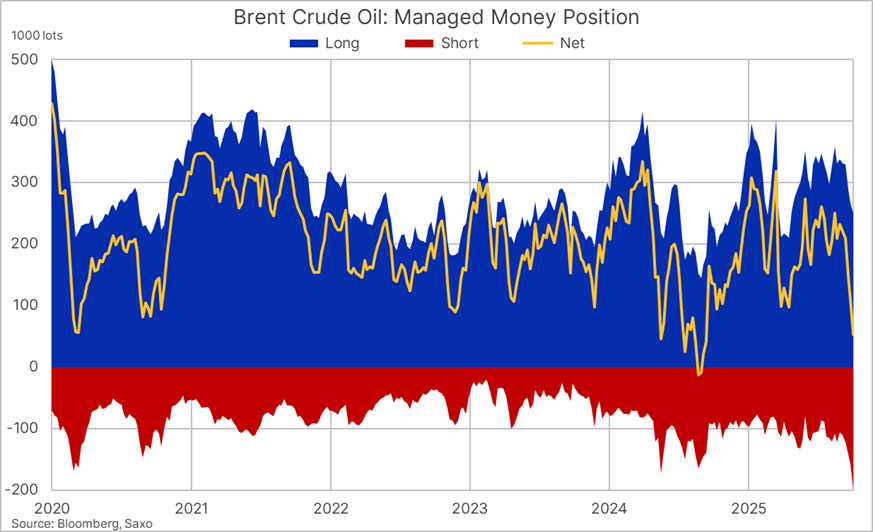

Thirdly, there is the buildup of a large short position in the market on these same weak fundamentals. The futures position in Brent Oil (traded in London) is reaching the shortest position in several years:

Unwinding this would be a bullish catalyst, as occurred in 2021 and 2024.

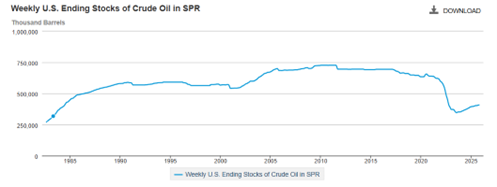

The last is the position of the USA’s ‘Strategic Petroleum Reserve’ (SPR), essentially a government owned backup to the oil markets. This has been over 600m barrels at the start of the Biden administration. To counteract the impact of Russia’s invasion, and to do well in the 2022 midterms, they sold this down aggressively- almost 300m barrels.

Trump ran promising to refill it. That would be a costly effort, as at current oil prices, that would cost around $18bn to top it up. But Trump has started to put his money where his mouth is and announced a 1m barrel purchase:

Now we acknowledge that this is not much oil. It’s 1% of one day’s global oil production/supply. But the larger signal we think is bullish. It shows that a major buyer who needs to add back 1m barrels a day over the course of a year is willing to put in a floor around $60 a barrel. We imagine other refiners etc would use this level as a ‘reasonable one’ to begin to rebuild supplies and secure future inventory. We think this level is unlikely to be broken to the downside from here on out.

To the upside tail risks category, we will come back to our work on Ukraine and escalation there. As of now, there is no direct conflict between NATO and Russia. Europe still takes in Russian oil, via intermediaries like India. It still takes in gas to several countries like Hungary and Slovakia. Attacks on Russian oil infrastructure have not produced any meaningful reduction in permanent supplies.

But if we get the feared escalation, then this would open two risks to global oil markets. The first is already playing out. Trump has heavily sanctioned Russian oil production and the majors that export it. He has tariffed countries trading in Russian oil, specifically India and China, and is forcing them to walk back their purchases of Russian oil.

While the implementation of this will be messy, it does increase the risk that Russia becomes relatively oversupplied and that the rest of the world becomes undersupplied as Russia gets further isolated from the global market. This so-called ‘basis trade’ may continue to open up as pressure to escalate the war or isolate Russia grows.

Goldman Sachs assumed a temporary hit of 1.5m barrels per day to global supply from the tariffs, then gradually coming back online or OPEC offsets. This is their graph showing a $10-20 six month boost to prices.

And the mother of all tail risks is that NATO and Russia go to war directly and began to target each other’s energy infrastructure in a meaningful way. Russian oil production remains almost 10m barrels per day, over 10% of global supply. It exports 3.8m barrels per day, a significant contribution to the global balance.

Assessing the likelihood and timing of this is obviously very difficult. But any reduction of Russian output by 1m or 2m bpd on a sustained basis would definitely cause global oil prices to skyrocket.

...Or the ADRs could be up 40% today! Wow huge move