May 2024 Monthly - Part I

Russia Turns Up The Heat on Ukraine, Could Trump Go To Jail?, Canada Mortgage Rollover Data A Ticking Time Bomb, Stagflation Is Back

Email: decodingpolitics@protonmail.com

Substack: decodingpolitics.substack.com

Medium: medium.com/@decodingpolitics

Twitter: twitter.com/DecodingPoliti2

*Not financial advice, merely pointing out political trends*

With so much happening on the political and macro front, we decided to do two updates for the month of May. This one will cover the stories of the past two weeks. The next one will cover the news of the bulk of May.

Stocks remain under pressure with higher than hoped for inflation readings and poor growth numbers for the US economy. We anticipate shares under pressure going into the fall due mainly to liquidity pressures, but also political wobbles. By November, we should start to see a relief rally as the election resolves without major incident.

Gold and oil have been correcting over the past few weeks after strong moves for the year. We remain structurally positive on both, for reasons we outlined in past pieces.

US Politics sees increasing risks of Trump being jailed, even if only for a short period of time. With just six months to the election and Trump ahead in nearly every establishment poll, expect continued heat by lawfare to keep him off the ballot. That would be a blow to risk assets everywhere. But the overall picture still heavily favors a Republican victory.

Also look for our coming tome on the entire BRICS+ strategy, moves, and likely future moves. It’s going to be very comprehensive because we want to make it the best available introduction to the topic. The amount of non-reporting on this shift in English is criminal now. Many of the world’s major powers have all banded together in a strategic alliance to kick the US out of Asia, defang NATO, and replace the US-led economic system globally. How is that not worthy of constant coverage? So we will have to step into the void and pass along the dozens, if not hundreds, of facts that they omit telling you. And connect the strategic dots.

1. Russia Turning Up Heat in Ukraine, Again

2. Canadian Mortgage Market – Higher Taxes, Great Mortgage Reset Coming in Next 24 Months

3. Could Trump Go To Jail? Odds Are Rising

4. Stagflation Is Back

1. Russia Turning Up Heat in Ukraine, Again

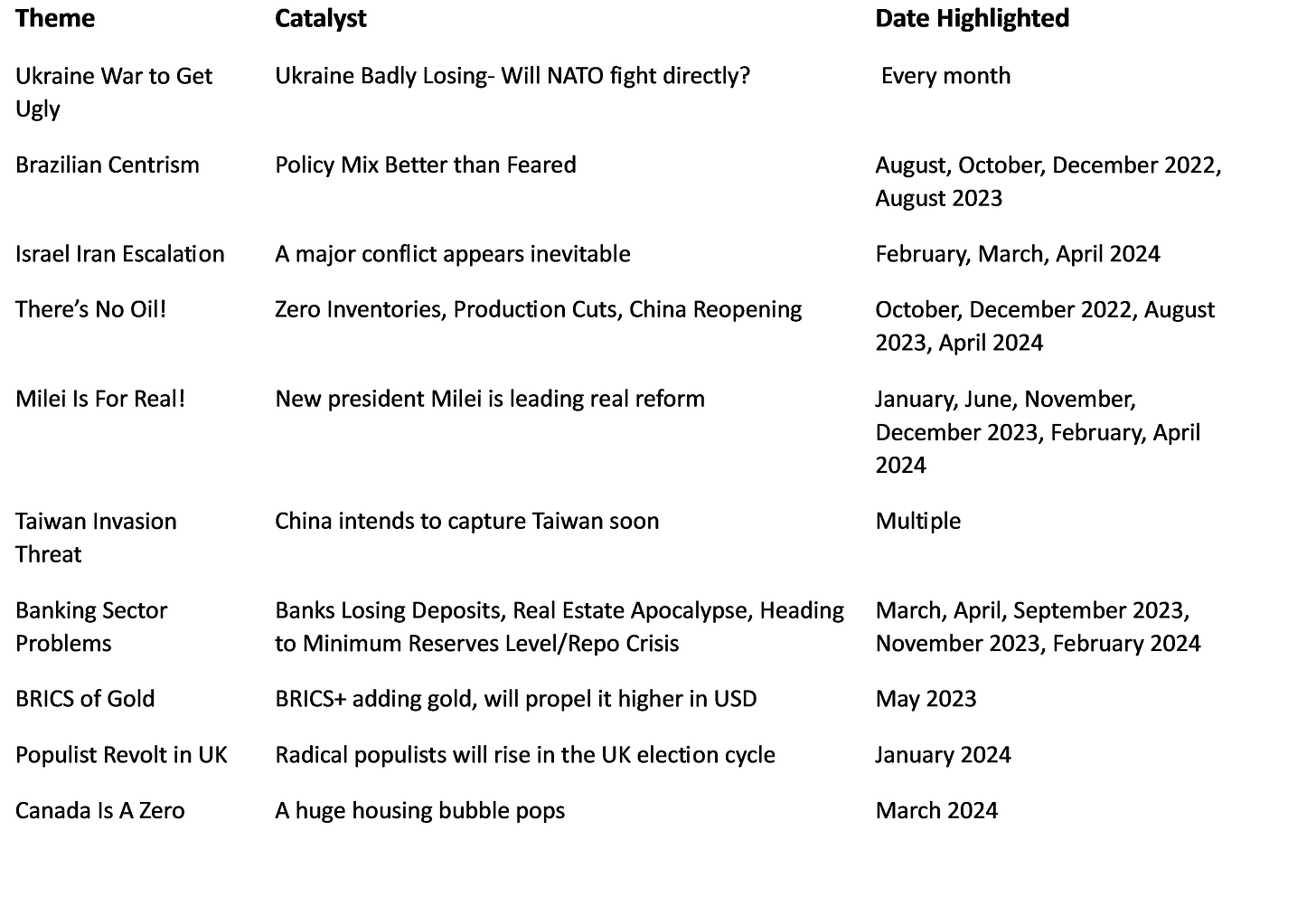

We always start with the Ukraine war, because it’s so mis-reported by the mainstream press. It is also the leading edge of the Russia/China axis, and so monitoring events here is a key to taking the pulse of the BRICS+ plans. It’s looking like they will increase pressure in Ukraine as Iran ups the pressure around the Middle East and China works to rip commodity prices higher.

With other things in the headlines now, it’s barely been covered for the past few months. Let us recap what’s happened in the past six months:

Russia continues to gain territory, consolidating gains around Avdeevka and surrounding towns

Russia has a decided advantage in artillery and air power

Ukranian recruiting and arms shipments from the West are short of what’s necessary to turn this around

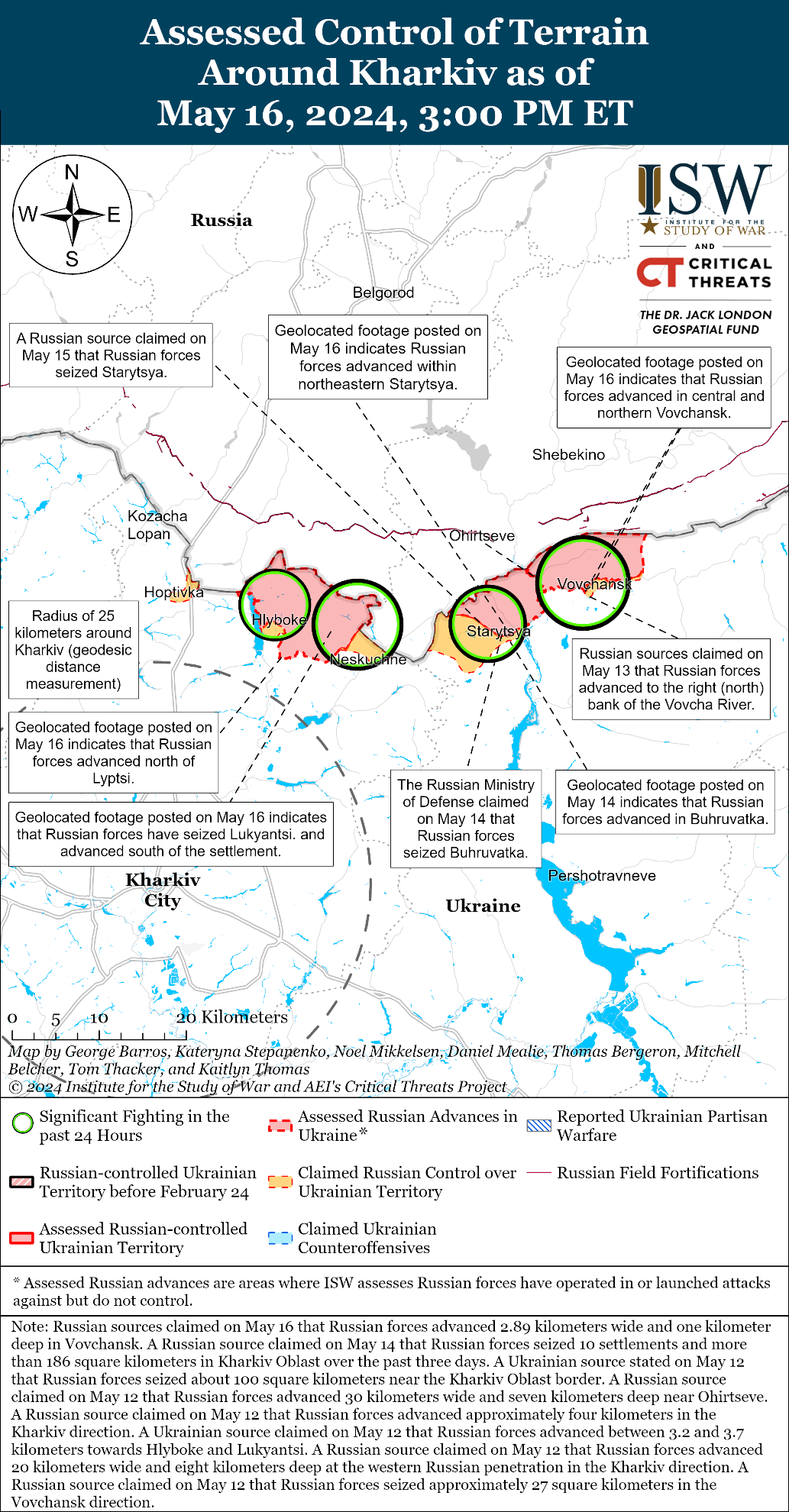

Russia has been moving aggressively on the second largest city, Kharkiv, taking several villages nearby it. This may be the start of an offensive to capture or the city. Or it could be a move to pull defenses from other places and move another target- perhaps Odessa?

Finally, it could be a broad offensive this summer to increase the pressure and force a deal. This is ahead of any potential NATO offensive and a desire to scare them off from even trying.

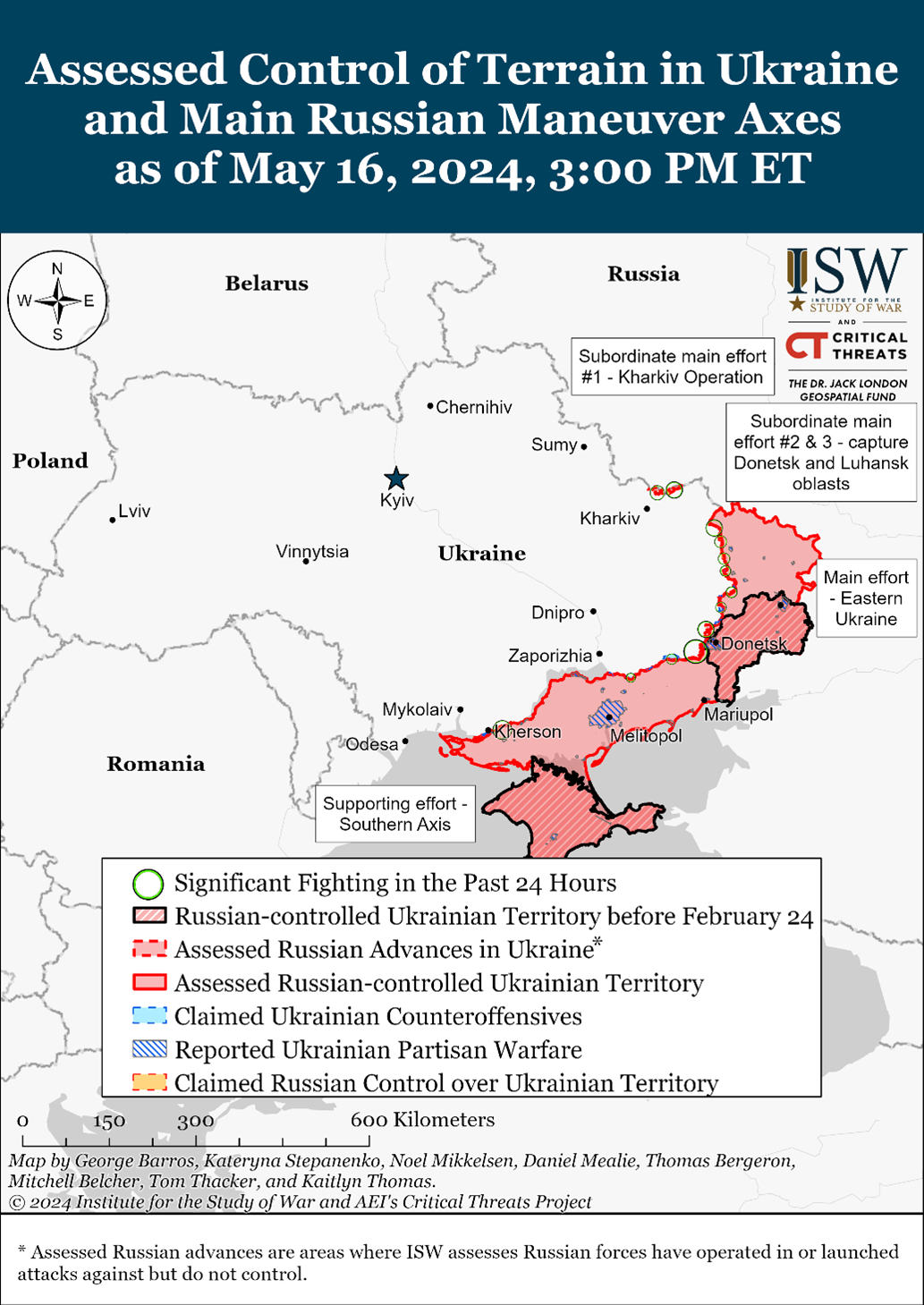

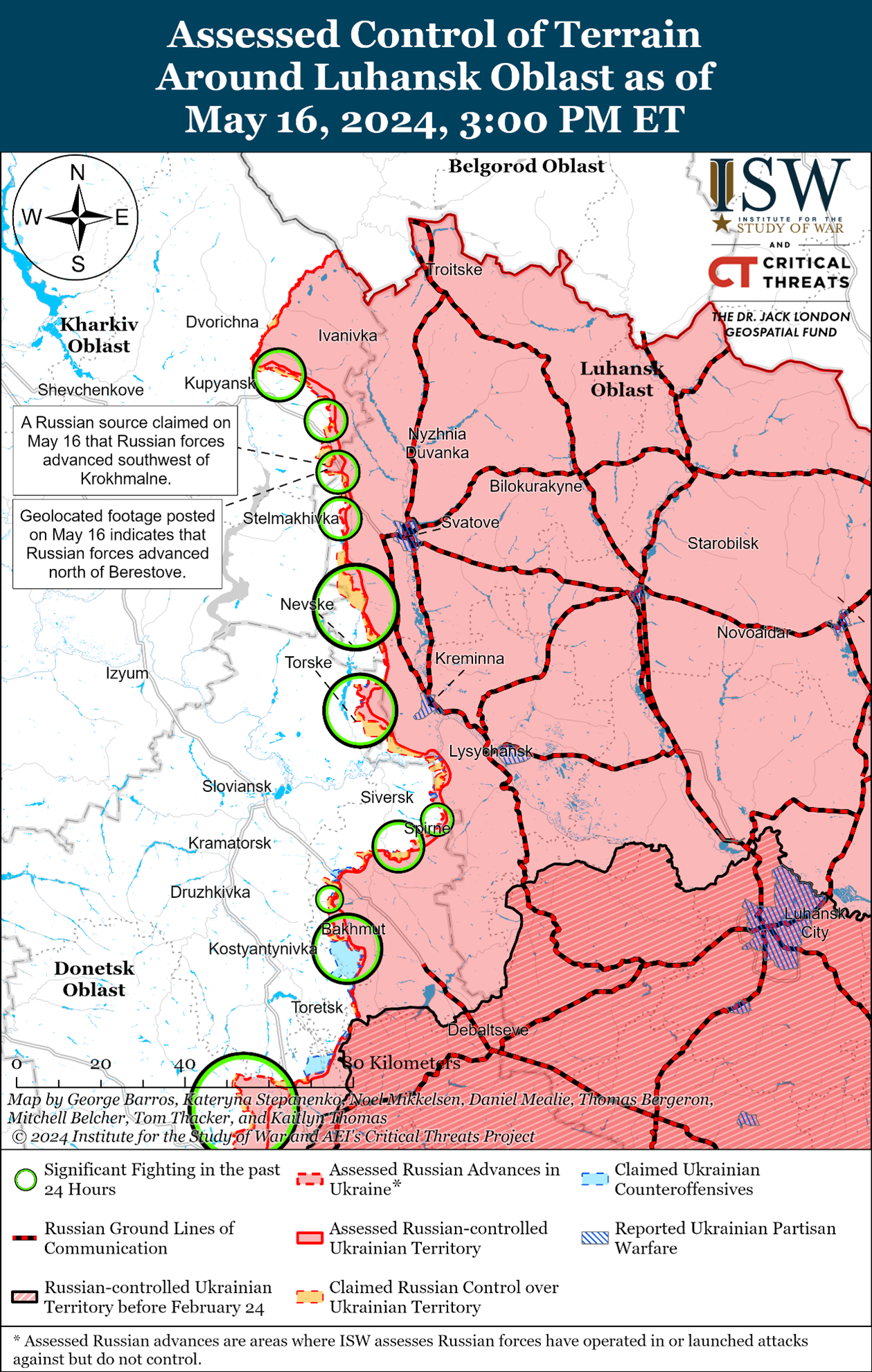

The Institute for the Study of War shows the breadth of the fighting (remember, the front line is longer than the distance from San Francisco to San Diego). The fighting has been broad, but Russia’s biggest gains are near Kharkiv.

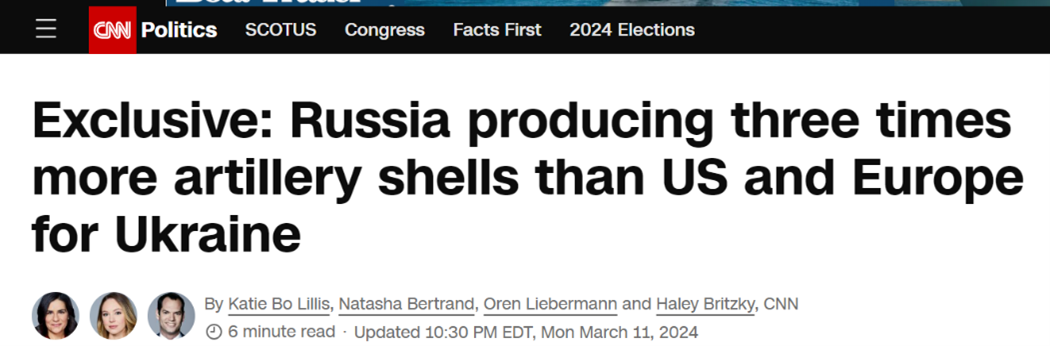

The math on money, personnel, and ammunition continues to look grim for Ukraine vis a vis Russia. Stories of Ukraine’s problems in recruitment abound, we will spare you those. Ukraine finally got $50-60bn out of the US government, but that pales in comparison to the aid packages of the past. But still, they are vastly outnumbered in artillery and other key items on the battlefield:

And that is the overall production rate. The numbers according to CNN are even more lop-sided on the battlefield:

Officials say Russia is currently firing around 10,000 shells a day, compared to just 2,000 a day from the Ukrainian side. The ratio is worse in some places along the 600-mile front, according to a European intelligence official.

At this point, the smart solution instead of pouring resources down this rathole would be to cut a deal that reflects the reality on the ground of the past several years. But NATO wants to keep this war, and the grift, going. Only until Ukraine is utterly spent, or Russia scores key battlefield breakthroughs, will this be over. That may come this year, but we will have to watch how things develop.

2. Canadian Mortgage Market – Higher Taxes, Great Mortgage Reset Coming in Next 24 Months

Two data points came out in April, after we wrote our April Monthly, that added fuel to the Canadian housing conflagration: higher capital gains taxes, and the coming tsunami of mortgage resets.

First on the capital gains. Canada is putting up the capital gains rate on investment properties as of the end of June. With the weakening market fundamentals, many people who were already looking to sell are going to rush to beat the deadline, creating pressure in the market.

“Under the current tax rules, if you dispose of capital property (other than your principal residence) for a profit, only 50 per cent of the capital gain is included in taxable income. The budget proposed to increase the capital gains inclusion rate to two-thirds (66.67 per cent) for corporations and trusts, and to two-thirds on the portion of capital gains realized for the year on or after June 25, 2024, that exceeds $250,000 for individuals.”

Well just how big is the second home/investment property market? Almost ¼ of the market (4.4m/16m ish) it turns out will be hit by this.

“Approximately 4.4 million Canadians own an investment property, with one-third of them owning two or more properties, according to a Royal LePage survey in May 2023. Moreover, 11 per cent of Canadians own a cottage, with an equal number looking to buy one, according to a ReMax poll in 2023.”

The other factor currently weighing on the market is the factor of mortgage resets. It had been difficult to get really accurate data for us, but we know that many borrowed before the high rates of 2023.

A recent article in the Canadian paper Globe and Mail went through the math on the mortgage market and the borrowers in Canada. The numbers are awful. We have only started to see the beginning of the reset in the market. It will deteriorate much more in the coming 24 months.

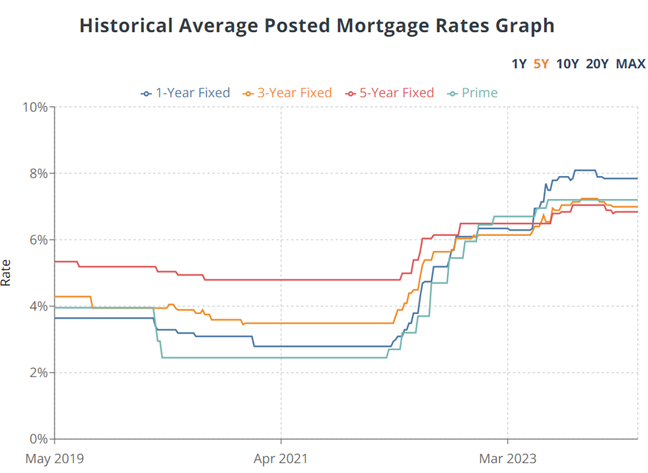

In our piece “Canada is A Zero” we broke down the functioning of the mortgage market. Most buyers in Canada have a rate that is fixed for five years and then resets. But mortgage rates have increased by 400bps in the past four years. New buyers are feeling the pain, but what about existing mortgage holders?

How many people took out mortgages when rates were low that are going to face a reset at these far higher rates? The article has some fun stats:

· There were three million mortgages taken out in 2020. By comparison, Canada only has around 16m houses. 77% of those 2020 mortgages had a fixed rate (around 4%), and almost all of those will reset in 2025 at a higher rate – monthly payments are roughly 70% higher than in 2020.

· Most of the Canadian mortgage market’s outstanding debt will renew in the next three years, again, at far higher rates than the original terms:

“Consider that there is approximately $2-trillion in outstanding mortgage debt. Only 5 per cent of that came up for renewal in 2023, according to Canada Mortgage and Housing Corp., with 13 per cent slated for this year. That spikes to 23 per cent in 2025, a whopping 31 per cent in 2026, and 21 per cent in 2027.” [70% from 2025-27]

If you think that the poor economy, poor affordability and higher rates are hitting the housing market now - wait until you see 2025!

With over 20% of mortgages in negative amortization already, as we previously pointed out, what will the numbers look like in two years? 40% ? This is going to produce a total housing market crash. Huge numbers of people who can’t afford their new mortgage payments, at the same time that new buyers are priced out of the market and waiting. Banks will begin shoving inventory into a falling market, exacerbating the problems of borrowers being underwater and trapped.

Due to these two factors on top of the poor fundamentals we outlined, a 10% decline in house prices this year and 20% next year would not surprise us at all.

The prior expectations that “The Bank of Canada will just cut rates and bail us all out!” also seems to be off the table. Like the Fed, it seems inflation has been higher for longer than originally hoped for. This would merely seal the deal for the rollover story. With zero help for any borrowers from lower rates, or only slightly lower rates, the pressure continues.

"While there was a diversity of views about when conditions would likely warrant cutting the policy rate, they agreed that monetary policy easing would probably be gradual, given risks to the outlook and the slow path for returning inflation to target," said the minutes.

Canada is A Zero!

3. Could Trump Go To Jail? Odds are Rising

Trump is facing innumerable legal issues, relating to the valuation of his businesses, his role in January 6th, and for hush money payments he allegedly made to keep an affair quiet.

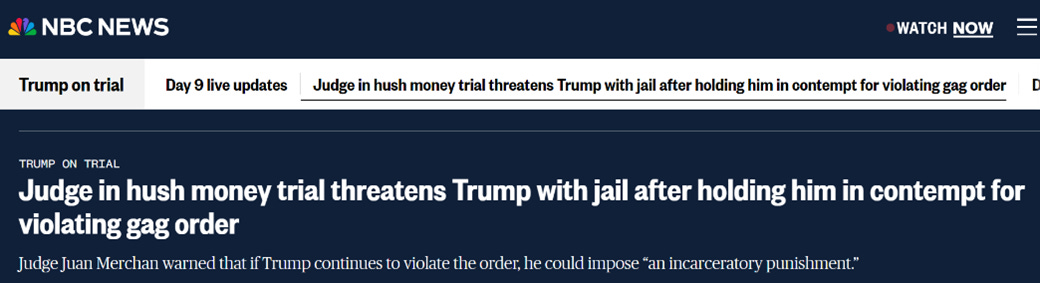

That last trial is now in the phase where Trump keeps tweeting about it despite the judge ordering him to stop. He has been fined nine times and now the judge is beginning to threaten potential jail time if he doesn’t stop.

We doubt Trump will stop commenting on the trial, so we will probably run right up to the limits of the judge’s patience. As we stated in our “Handicapping the Presidential Election” piece we think a 50% chance Trump is in jail at some point in this election cycle. He has too many trials and too many enemies who want him there, regardless of the legal merits.

A recent Time interview confirmed how high the stakes are. Trump basically said he would declare war on the Establishment if he wins a second term, gutting the civil service and the appropriations process. He promises active legal hell similar to his own for his opponents. The need for the entrenched Washington to stop him continues to rise.

But could this specific trial and contempt of court take him out of the race?

New York law (we looked it up) says up to 30 days of jail time per violation of contempt of court. So Trump would have to be cited six times, and jailed 30 days per time, to miss the election. But certainly the headline factor of Trump sitting in a prison cell would not be good for markets. Trump being removed from the ballet would be even worse.

If Trump needs to be replaced due to this case or another one, who takes the mantle? We are hearing Florida governor Ron DeSantis, former candidate Vivek Ramaswamy, and former cabinet member Ben Carson as the three top choices. All would be pleasing to the Trump base. All would be decent campaigners, although Vivek is head and shoulders above the other two. But they also lack the name recognition of Trump.

However, given Biden’s approval rating stats, the likelihood of him losing and a Republican winning is high. Biden’s numbers are too low for him to mount a credible campaign. If the economy continues to deteriorate, he will be in even weaker shape. Biden has the lowest approval rating of any incumbent running for a second term in the past 70 years, lower than those who lost reelection in 1980, 1992, and 2020.

We think we may have an interesting May-July period then, where Trump is either jailed and off the ballot, or merely facing a revolving door of being in and out of jail. Markets would not like it. But then as clarity and a big Republican lead starts to become apparent, markets would start to breath a sigh of relief by the election in November.

4. Stagflation is Back

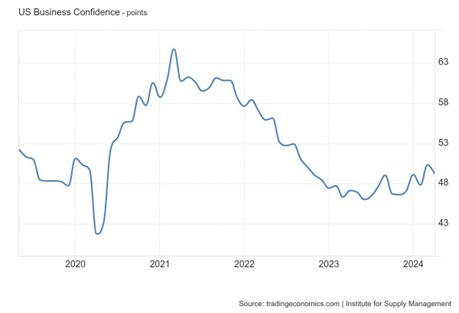

Like clockwork, the first of May saw the release of the US’s manufacturing Purchasing Managers Index, the ISM. This index’ headline number remains very weak, at 49.2 (over or under 50 indicates expansion or contraction). The index has been at or below 50 since October 2022, suggesting we are in a very weak if not recessionary economy.

US ISM Manufacturing

The worrying part was the spike in the prices paid index, which is now rising at the fastest pace since the inflationary wave of late 2021:

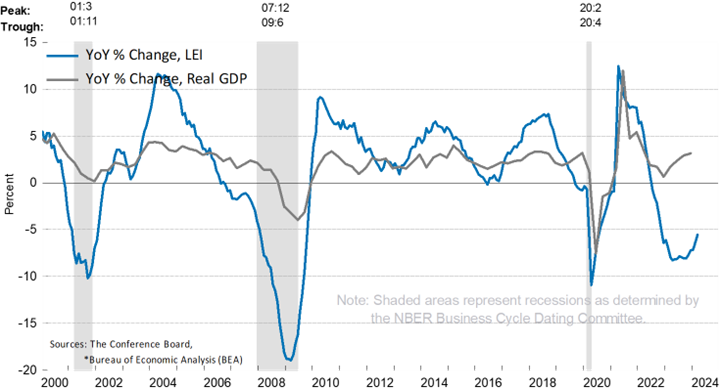

The Leading Economic Indicator has improved slightly of late, but remains in recession territory.

This has very much put the Fed in a bind. Real rates have risen substantially and growth has stalled since they started hiking in 2021. Inflation has come down from 9% to 3%. But it’s still not close to their 2% target. Instead of cooling, it seems to be re-accelerating. Instead of being able to cut 200bps to help growth out, it appears the Fed will have to sit on its hands. The May 1st Fed decision saw them say at the press conference they still may cut rates this year and had the easing bias they adopted earlier this year. But at the same time, the Fed statement shut the door to rate cuts in the near term:

…. the [Fed’s Open Markets] Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

Powell said at the press conference he saw “neither the stag nor the inflation”. We beg to differ.

If inflation picks up for the next six months, then the Fed may have to raise rates into a very weak economic environment, guaranteeing a recession.

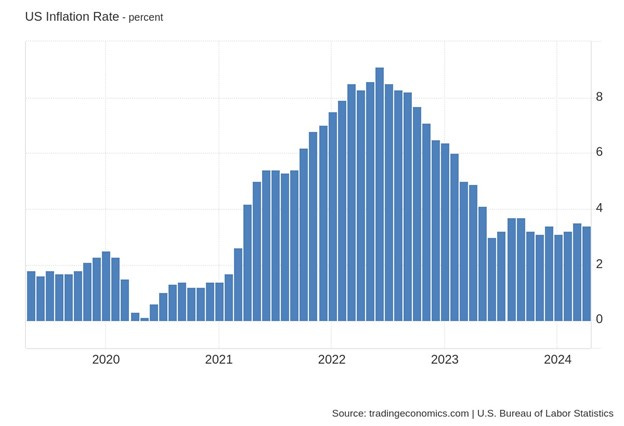

One may ask “But Decoding, the US CPI release on May 15th was lower than expected! What do you say?” We agree, yes, it was below expectations. But it was still a high 3.4%, and putting it in a larger perspective, inflation has still been around 3.5% for the past year. It remains vastly above the Fed’s 2% target rate.

We have written extensively on how the market continually underestimated inflation and the Fed’s response to it. In the near term, inflation looks headed slightly lower and perhaps the Fed will do an adjustment rate cut.

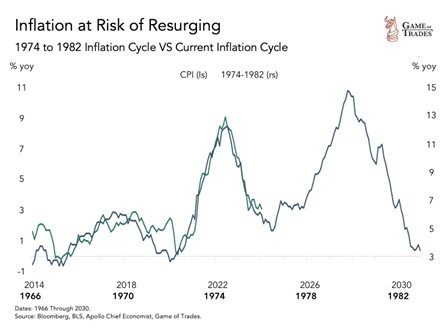

But, zooming out, it’s clear that would be a lull in a stagflationary period. We are following the 1970’s parallel far too closely for comfort, which implies that inflation will spike in the next three years to double digits:

The stagflation playbook is a simple one. Metals and energy do extremely well. Short term fixed income or cash keeps pace with inflation. Long term fixed income gets hammered. And growth and value stocks alike de-rate. Plan accordingly!